Credits is a new open source platform for creating and managing financial services based on blockchain / ledger Credit.

Currently, opinion leaders are blogs on YouTube channels and social networks, where money is publicly invested and ICO, and information is stored in a centralized cloud system.

The financial industry is probably one of the few industries left behind, which rejects the direct interaction between central and participant introductions. Although technically, creating a decentralized financial service is much easier than creating an unmanned vehicle.

Establish a system that incorporates all participants and the nature of the required financial sorting services: user personalization, KYC, credit bureaus, clearing clearing centers, encoding and encrypted currency exchange. This is the latest obstacle to the development of peer-to-peer financial products from two basic tasks.

Now is a solution to these tasks, CREDITS (http://credits.com) - A single decentralized technology platform can combine all financial service participants with the principles of the ledger distributed securely and quickly perform all transactions.

Blockchain-based unique system allows us to build high-speed transaction processing financial services, up to 100 million times per second, the average transaction processing speed in 3 seconds. Credit really offers new opportunities to use blockchain technology in the financial sector.

Credit is present to create a new platform to operate financial products, in a unique way to build chains with smart contracts / ledger, can be achieved:

* Process transaction up to 1 million caliper seconds

* Average processing time per transaction for 3 seconds

* The cost of handling is very cheap

BITCOIN / ETHEREUM

* About 100 transactions per second

* Average processing time is 0.5-15 minutes

* Cost per transaction becomes $ 0.02-0.5

Popular platforms such as Ethernet are not suitable for financial transactions because the deal is very slow at 0.5-15 minutes, and the cost per transaction is around $ 0.02-0.5. The financial industry is unacceptable.

CREDIT is designed to achieve one million transactions per second with an average processing time of 3 seconds and an average peak of 10 seconds. The system is a distributed database with the principle of blockchain / ledger - the management and transactions of distributed digital assets, invariant records.

The CREDITS platform provides the implementation of unique new blockchain technology, smart contracts, data protocols, and has its own internal encrypted currency. It is a platform with new network technology capabilities, speed, transaction costs and total transactions per second. It is an open platform, meaning that users and companies can use block chain agreements to create online services.

The CREDITS platform provides solutions for low speed and high transaction costs. This expands the application of potential blockchain technologies in the financial and network industries. Credit's mission is to introduce blocked technology and crypto CREDIT technology everywhere, and make decentralized relationships a reality.

Token

CREDITS digital tokens will be published in limited numbers. All CREDIT digital tokens must have the same functionality.

The token sale will be on the Ehereum platform in the ERC20 standard. Initial sales date, In order to immediately begin the design and development of the project, we propose to spend up to 2 ICO rounds.

* PRA-ICO - in October 2017

* ICO Round 1 in Nov-Dec 2017

* ICO Round 2 in 2Q 2018

The number of tokens available is set at 1 000 000 000 tokens. In the 1st round of ICO in Nov-Dec cover 80,000 ETH, hard cap 120,000

Total 100%

2% for bounty

2% for postal gifts

15% for founders and teams

Operation 5%

1% for advisors

75% for Pre-ICO and ICO campaigns

Bonus for PRA-SALE purchase

Bonus for PRA sales - 30%

Special contrast in Whitelist before PRE-ICO (send request or to info@credits.com).

Bonus limited token of purchase amount

0% - up to 50 Ether (15,000 USD)

20% - from 50 Ether (15,000 USD)

25% - from 100 Ether (30,000 USD)

30% - from 250 Ether (75,000 USD)

35% - from 500 Ether (150,000 USD)

40% - from 1000 Ether (300,000 USD)

Users may purchase CREDIT digital tokens during the ICO Period by exchanging ether (ETH) or Bitcoin (BTC) for CREDIT digital tokens with 1ETH exchange rate per 4000 CREDIT digital tokens, and other bonuses may be applied in accordance with Token CREDIT Token Agreement rules

The CREDIT Purchase Agreement between CREDIT and the User shall commence upon receipt by the User of all the terms of the CREDIT Token Agreement by clicking the buy button or by purchasing a number of CREDIT digital tokens and using part of the smart KREDIT and CREDIT LINK contract, and will continue until terminated accordingly with the terms of the CREDIT Token Sale Agreement.

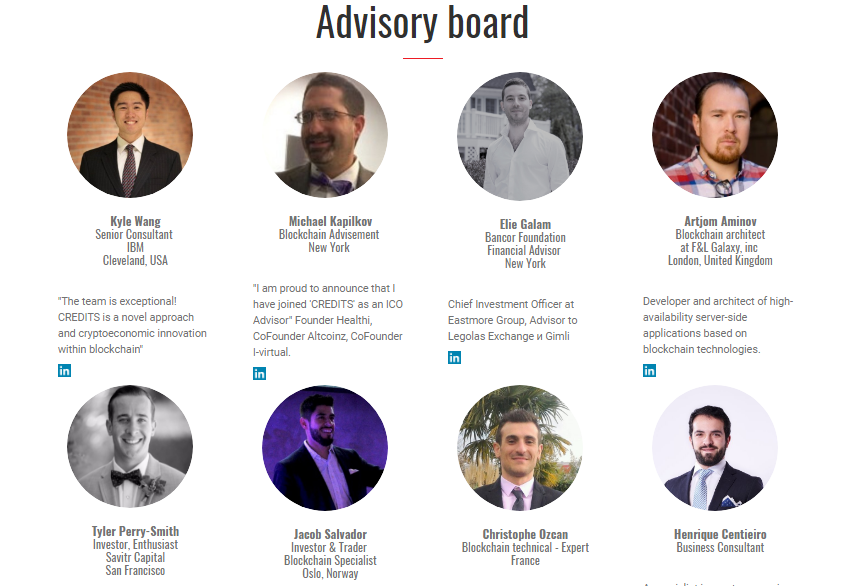

CREDIT projects do look good but are still in the early stages of development and areas that aim to cover the highly competitive market. The team looks good and they have some serious and experienced advisers who support them which is always a good thing to look at. If they give everything they expect on their roadmap, then it may be one of the major players for a blockchain financial solution. ICO ICO is an ICO-based investment project.

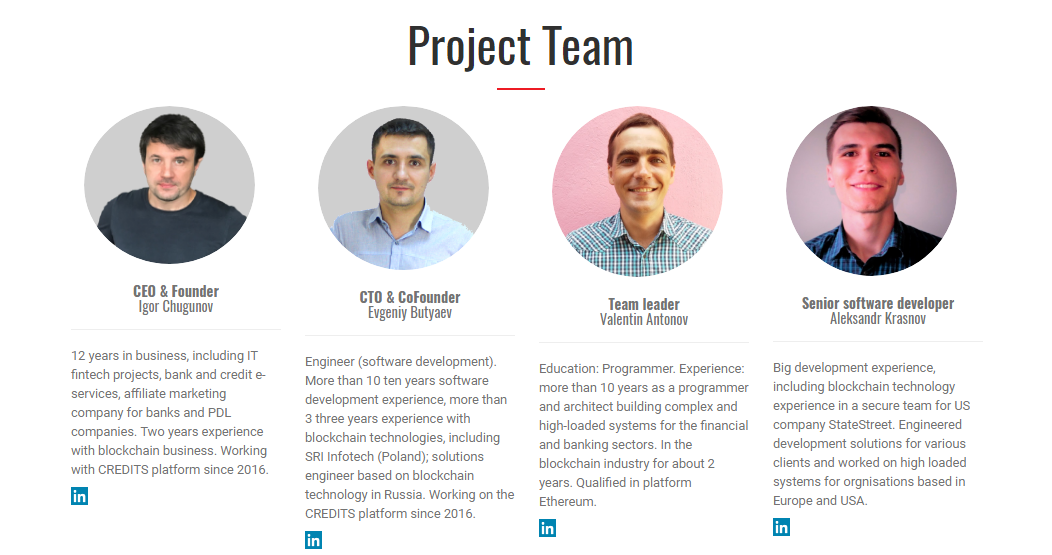

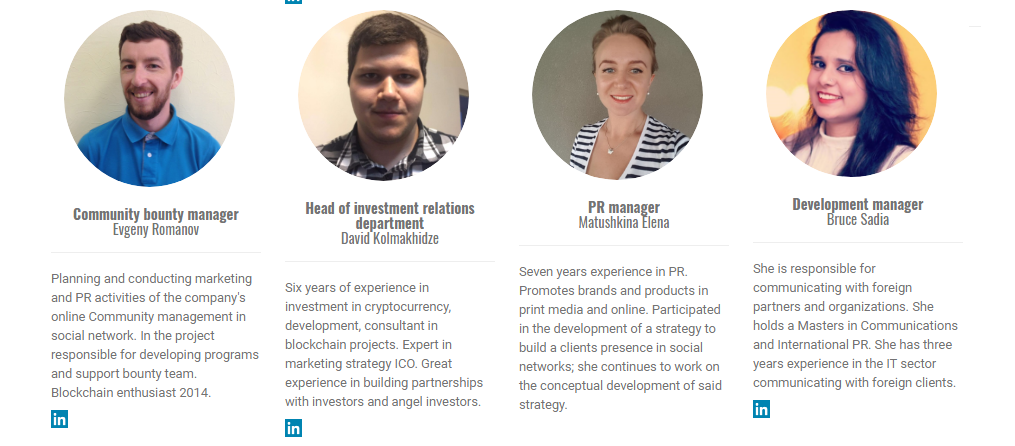

Team

Great projects need a great team too. CREDITS has a team of highly skilled and intelligent people who constantly strive to make the platform a standard center for community members to understand the essence of technology.

Website: http://credits.com

Whitepaper: https://credits.com/Content/Docs/TechnicalWhitePaperCREDITSEng.pdf

Twitter: https://twitter.com/CreditsCom

Facebook: https: //www.facebook .com / creditscom /

Telegram: https://t.me/creditscom

Author (iyanfoursix46): https://bitcointalk.org/index.php?action=profile;u=1061980

Komentar

Posting Komentar