The Vernam Project is an honest effort to revolutionize and digitize the insurance industry by implementing high end technology solutions so as to minimize costs associated with insurance services. For all intents and purposes, Vernam initially targeted Europe.

One of the largest industries in the world is Insurance. By 2016, it's worth $ 4.73 trillion. It now grows at a 3% CAGR. The size of the insurance market in Europe, North America, and Asia is slightly different. The premium amounts to $ 1.47 trillion, $ 1.46 trillion and $ 1.49 trillion respectively. Despite the inclusion of personal device connectivity, technology, AI and blockchain, the industry has not yet witnessed a radical transformation in its operating business model. Of course, there are positive outcomes such as cost savings, better insurance experience, increased expectations, automation, and personalization etc. That said, the business and operational landscape has not changed in aspects like democracy, transparency, and efficiency.

They are the backbone of the current insurance industry that is getting in the unwanted legislation and failing to claim compensation. They may be one of the largest industries but the broker is the only entity in this chain that gets the lion's share. A total of 30% premium policy commissions are accepted by insurance agents and brokers. In addition, the industry is still far from being adapted to current technological advances that are similar to other business sectors.

Solutions Offered (https://www.vernam.com/)

VERNAM offers to build a market for various insurance products from various companies based on blockchain technology. Under Smart Contract, Insurance will be given to platform users. Because this platform works for customers worldwide and there are different laws in each country, they have created a worldwide Smart Insurance Contract registry for the purpose of connecting different lists from different countries.

insurance requires risk management, Risk management is all about scoring carefully, diligently managing and transferring risk intelligently. Despite the emergence of various types of insurance, insurance insurance, insurance, insurance, health insurance etc., the underlying operating model for all insurance companies has become an element called 'premium'. For your information, the most dominant insurance in Central and Eastern Europe is motor vehicle insurance. Since 2015, said InsurTech to be a keyword. This is a mashup of two words - Insurance and Technology. In the US, UK and Germany markets, investment in InsurTech is on the rise.

Companies are banking on large data to create customized services and insurance products. These companies are using AI to switch from human-operated actions to fully automated routines. Thanks to smart contracts and blockchain, efficiency and privacy are guaranteed. All this is fine, but most of the insurance value chain is associated with distribution. The main stakeholders in distribution are agents, brokers, underwriters, and insurers. As a result, the entire insurance process is getting slower and boring. And yes, a lot of money will be a margin so leave a little money for the payment of claims.

The Vernam project is on an ambitious mission to change the insurance system by eliminating intermediaries. Vernam Market solves the problem and the Market is associated with a joint ledger that not only increases transparency but also minimizes transaction costs, Data manipulation by unauthorized parties is prevented.

Insurance agents and brokers will be part of networks created by platforms in various countries. Optimizing the risks associated with various insurance products, they are ready to revolutionize the insurance industry. By Connecting a network of brokers and insurance agents around the world with people, they create a platform that everyone can trust. Their main focus is on crypto for crypto insurance products that will revolutionize the Insurance sector.

Vernam uses blockchain technology to provide:

* Competitive online marketplace for conventional insurance products by the largest insurance companies.

* Generous compensation - up to 30% of the policy premium in Vernam token (VRN) is returned to the client.

* CryptoSafe "- a smart contract, ensuring that when a series of events is created, the client will be compensated with certain Vernam Tokens (VRNs), the newest and most innovative blockchain-based insurance product Vernam will introduce.

VRN Token (Vernam) (Ethereum-based standard token ERC20) is used to make full use of this platform. Clients can purchase conventional insurance through this market. They will receive the award in the same VRN token as the broker's commission.

*ICO INFORMATION*

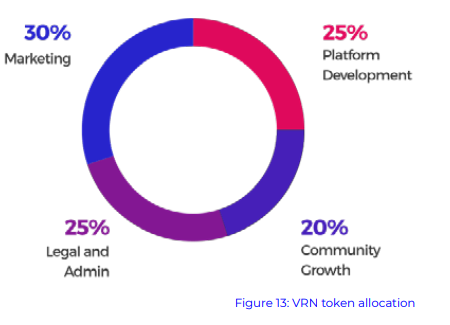

1,000,000,000 VRN Tokens are created for the project in which 50% will be available for the ICO. 30% OF THE funds will be used in the marketing of the platform while 25% of the funds will be used for the legal and admin purposes.

30% of the token sale funds will be allocated to cover social platform and other marketing channels, including website and content development, the organization of events, etc. Legal and administrative fees will be substantial, given the platform’s target of registering brokers in two EU countries by Q2 2019 and covering 8 countries by the end of 2020. Therefore 25% of the token sale funds will be directed to cover such expenses..The remaining 20% will be used for network development.

*Token*

Start Of token crowdsale : April 2018

Overview

Token name : Vernam Token

Token symbol : VRN

Total VRN token amount : 1,000,000,000

VRN Hard Cap : 500,000,000 VRN

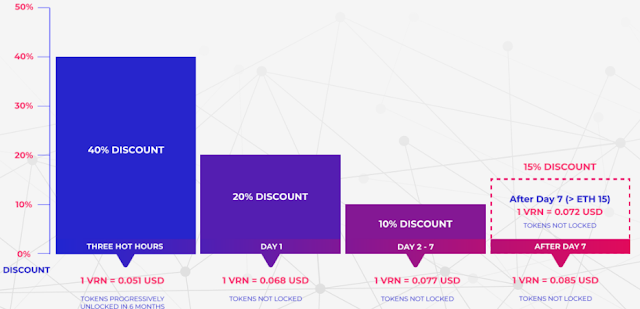

Conversion Rate : 1 VRN = 0.051–0.085 USD

*Bonus Scale*

*Conclusion*

There are many insurance companies looking to cover everything that you own. They are ready with their countless proposals to suit your needs and they have been fairly successful which is quite evident from their Market capitalization. The insurance industry is stable and successful. They are an industry worth 4.73 trillion dollars. Perfect fit for every situation in life, they have got you insured. The insurance market is ripe for the revolution.They are planning to expand in the coming future in the other countries of the European Union. While there are still many hurdles in the realisation of full potential of the platform, they are working hard to achieve the milestone.

Obtaining an insurance would be much easier when you have all the information, and this platform aims to lead in the positive direction of open information about the product. Standardizing the information and procedures regarding the insurance for a person is the ultimate aim of the platform.

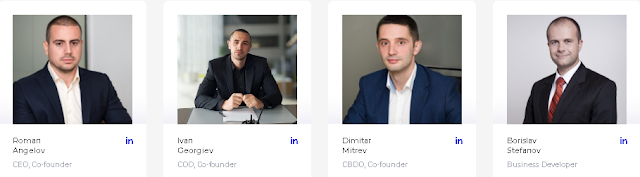

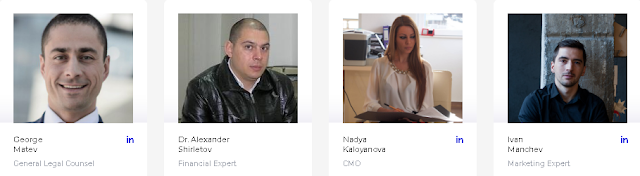

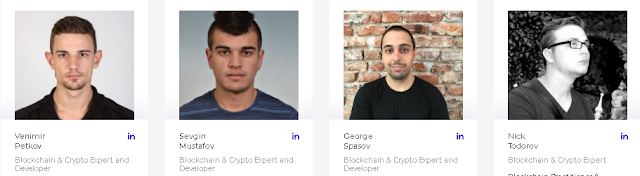

*TEAM*

The team is very enthusiastic about developments in the insurance sector with the introduction of their platform. They are open to collaborating with like-minded people.

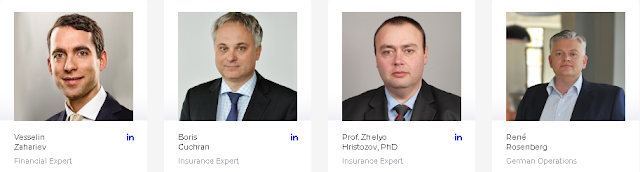

The vernam team consists of people with experience in the field of insurance and blockchain technology, and has the support of an advisor who will continue to provide input for Vernam's future development.

Further information:

Website: https://www.vernam.com/

Telegram: https://t.me/vernam

Twitter: https://twitter.com/vernamofficial

Author (iyanfoursix46): https://bitcointalk.org/index.php?action=profile;u=1061980

Komentar

Posting Komentar