Invox Finance is a platform that provides transparency of account financing concepts. It's built using Blockchain technology, which makes it transparent and paperless. It not only provides openness, but also has outstanding functions that make financing.

The funding of customs revenue depends on the buyer's invoice from the seller's seller. As a result, financiers agree to advance the money to the dealer on each account. Buyers who buy goods from the seller must pay the investor with a special invoice.

The decentralized Financial Invox Platform allows you to create dynamic invoices on distributed books, which benefit all parties from increasing trust, transparency, efficiency and security at minimum cost. Account fragmentation allows investors to spread the risk to hundreds of invoices, enabling investment with low risk levels with maximum impact.

The Invox Finance platform is a distributed decentralized distributed distributed loan platform that will enable dealers, buyers, speculators and other specialist organizations to specifically link, collaborate, share and data accordingly. The platform plans to create a secret condition by encouraging candor between the parties and compensating for its implementation. This platform will interfere with and reform the financing of adat acceptance by executing a framework in which trust and openness in all meetings are generated through an unedited gift framework. In addition, the execution of exchange and data flow will not be subject to a single, integrated single specialist collaboration, but managed by the standard direct arrangements applied to fully disseminated records.

Led by a stellar team with more than $ 30 million in invoice financing behind them, Invox Finance creates a decentralized cross-border invoice loan platform that will allow sellers, buyers, investors and other service providers to directly connect, interact, share and distribute information. Currently, the invoice industry is held by: high interest rates, lack of inter-party contact, high risk, lack of investment divers, dispute, abatement, bankruptcy. The Invox Finance decentralized platform allows dynamic invoices to be generated on the ledger to be distributed, benefiting all parties from increased trust, transparency, efficiency and security at minimum cost.

The Invox Finance decentralized platform allows dynamic invoices to be generated on the ledger to be distributed, benefiting all parties from increased trust, transparency, efficiency and security at minimum cost. Invoice fragmentation allows investors to spread their risk across hundreds of invoices, enabling low-risk investments with maximum return.

The founders of Invox Finance have many years of experience running a successful invoice financing company in Australia - ABR Finance. ABR Finance has been in operation since 2012 and has helped fund businesses across Australia with $ 30 million AUD in invoicing, across industries including IT, wholesale, construction, transportation, engineering, equipment and labor, publishing and professional services. ABR funding will also partner with the Invox Finance Platform to provide savvy early investors for sellers.

The Invox Finance platform will link merchants, speculators, and buyers on one platform, as well as outside specialist co-operatives, (for example, FICO's assessment offices and insurance agents owe people). It is important that the company's merchandise and buyers are linked to the platform and can confirm the application and dynamic acceptance information approach. The buyer will also be compensated with the Invox Token to confirm the application.

*Fitru Offered Invox*

* The Invox Finance platform will enable sellers, buyers, investors, and other service providers to directly connect, interact, share and distribute information.

* Sellers will be able to obtain financing at lower interest rates than those normally received from traditional investors operating outside blockchain.

* Dynamic invoices provide all parties with the ability to update invoice information in realtime, ensure conservation and manage access to sensitive information.

* The Invox Finance platform will give sellers direct access to individual investors.

* The Invox Finance platform will expose investors to loan products consisting of loan fragments from various businesses in various industry sectors.

* Credit invoices will be fragmented into smaller ones allowing investors to purchase loan fragments to reduce their risk profile and increase their diversification.

*Token Details*

Invox Tokens will be created on the Ethereum network using the ERC-20 standard and will provide utility users to provide access to the platform through the Trusted Members Program, rewards work performed for the program (invoice verification, invoice payment, and invoice settlement.

The company also launched ICO, the goal is to pre-sell the membership through the sale of artificial tokens. You receive a token at a discounted price to participate in the ICO.

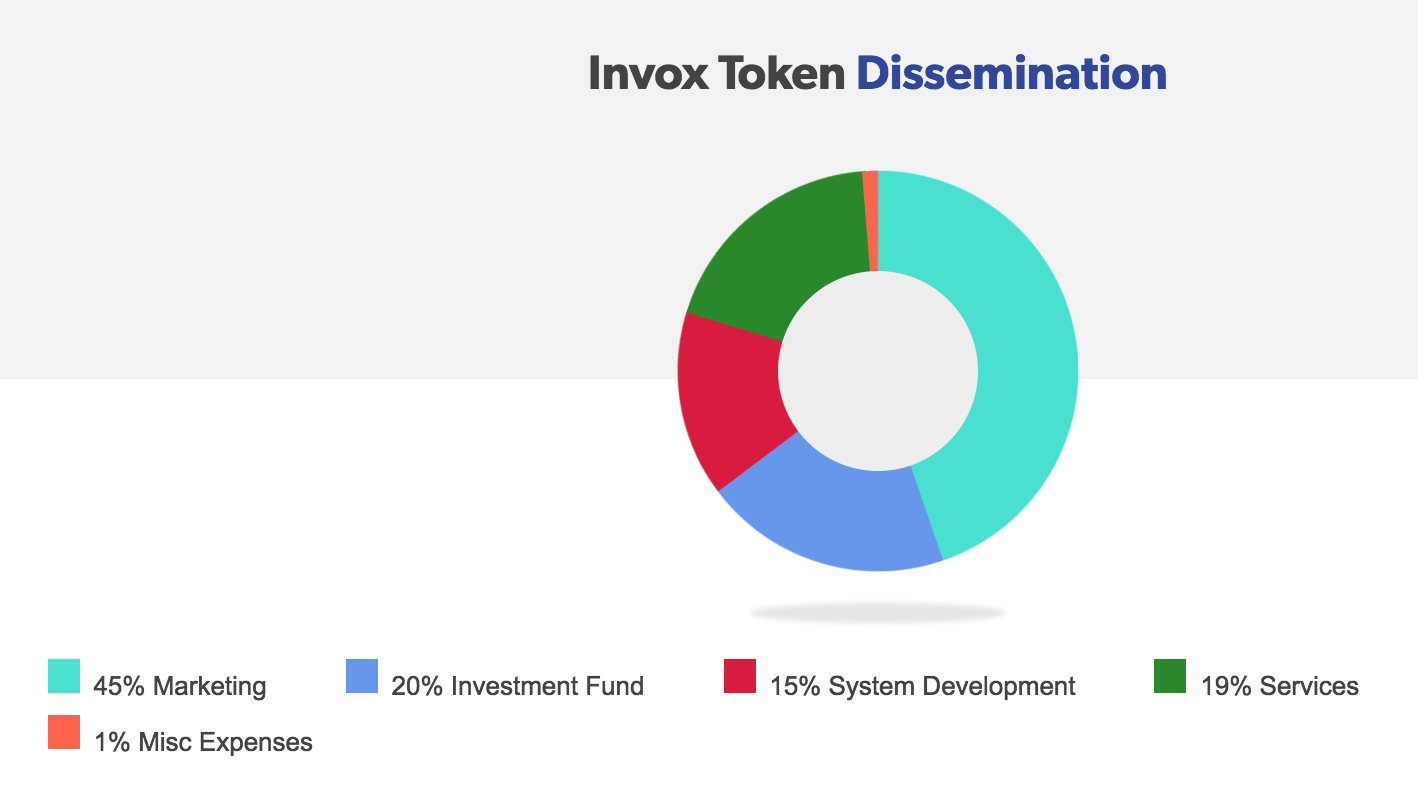

Distribusi Token:

Marketing: 45%

Investment Fund: 20%

System Development: 19%

Other: 1%

Token is offered at a rate of 1 INVOX = 0.0001 ETH, with a maximum limit of 20,000 ETH (about $ 17 million USD). With a pre-sale cap of 2,941 ETH (about $ 2.5 million USD).

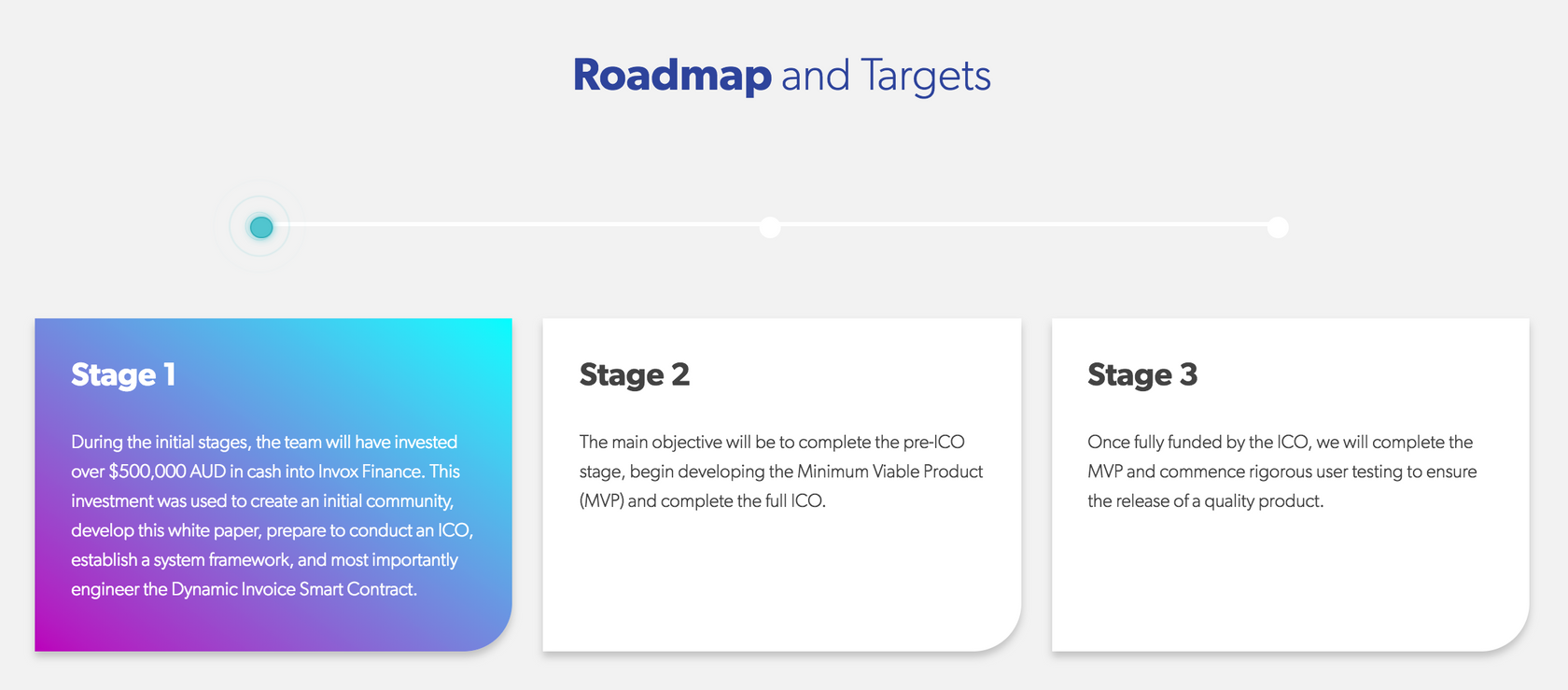

*Roadmap*

Invox Finance Platform team to launch their platform. Their main focus is for Australia and New Zealand, and then the United States and Singapore, then Britain, France, Germany, and the Netherlands, Poland, and Russia.

Website: https://www.invoxfinance.io/

Whitepaper: https://www.invoxfinance.io/docs/Invox-Whitepaper.pdf

Twitter: https://twitter.com/InvoxFinance

Facebook: https://www.facebook.com/invoxfinance/

Telegram: https://t.me/InvoxFinanceCommunity

Author (iyanfoursix46): https://bitcointalk.org/index.php?action=profile;u=1061980

ETH Address: 0x5ad1153dC8678080f34e0b823d44eC357d403197

Komentar

Posting Komentar