Bitbond is the first decentralized commercial loan platform that operates in more than 80 countries around the world. Proiek is owned by Bitbond GmbH, società di ricerca di Berlino. The founding company owns one of the most serious financial licenses in the country provided by state financial regolatore. For the founders of Bitbond, this is a great honor and responsibility for clients and government institutions, also considering that this is the first chain block statement in the country to accept this license.

What must be emphasized in the history of the project is that, in its complete history of its existence since 2013, Bitbond GmbH has succeeded in establishing itself as a reliable partner in many countries in Europe and Africa. The company has opened credit lines per more than 3,000 small and medium-sized businesses worldwide, including at more than 13 million euros.

At present, the founders of Bitbond can provide monthly loans in the amount of around 1 euro, which is a valuable result, whose achievements, as claimed by the developer, do not intend to be terminated.

*Introducing BITBOND*

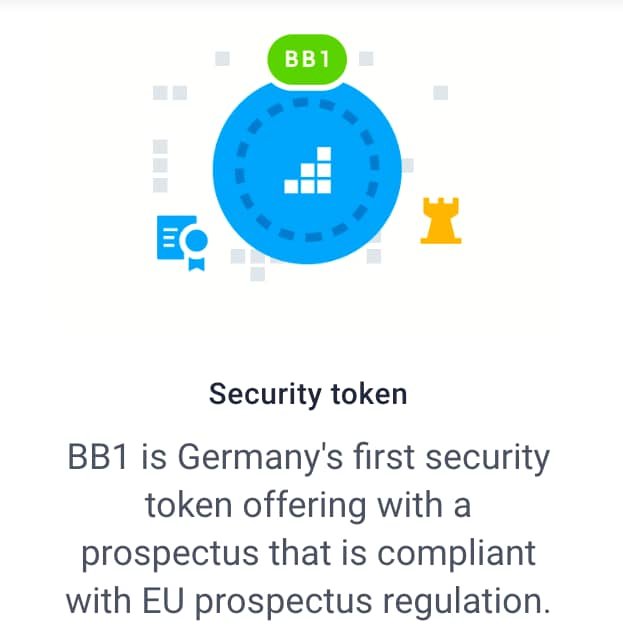

This fascinating Bitbond Security Token Offering (STO) infrastructure originated from the technically savvy Germany – Basically, it is a universal blockchain based infrastructure for lending. Since crackdown of ICO by SEC following the inability to meet the country’s financial security criteria, STO's are rapidly seen as the requisite alternative. The STO in a similar fashion with ICO's obviously are used to raise funds for establishments, however, owing to the fact that bodies charged with regulating it ensure its 100% lawful.

We have come to a point where decentralized platforms are important in our daily affairs. At the time digital assets became prominent with the launch of Bitcoin (BTC), no one expected that it would come this far. Just as these currencies improve digital transactions, they also help in solving real-world problems. Getting loans through centralized entities like banks usually entails going through stress, waiting for so long, and maybe at the end your loan won't be granted probably because it didn't meet requisites like collateral security. The Bitbond team want to curb this arising issues by enacting a more robust approach crypto lending solution.

100% regulated

The latest trend in the cryptocurrency world

It is experiencing rapid growth

STO projects are trustworthy having little or No scam potential

No unnecessary market speculation.

The cardinal objective of the project is making loans or working out capital financing to be accessible to a numerous number of SME's (small and medium-sized enterprises) in order to grow their establishment and also providing investment products where investors will have the ability to get returns. These are achieved by carrying out transactions using the innovation of the blockchain.

There are lots of fantastic features for businesses on board the blockchain but the payment feature holds the infrastructures primary focus. Take for an instant an Indian businessman wants to invest in a Nigerian business, he would easily carry out transactions, using the platform beating expense and time. Small businesses seeking loans after registering and opening accounts, will have their applications transferred to suitable investors who would then verify the accountability of the business. Once done, cryptos will be converted to fiat and vice-versa and then transferred.

*Benefits*

Bitbond has many advantages over traditional payment structures like SWIFT. In addition to offering low fees, it also ensures real-time transactions without intermediaries.

*The STO Approach*

It's important to protect users from the continuous acts of hackers that are ready to cause them massive loss. In light of hacks on exchanges and a palpable fear of losing one's assets, Bitbond opted to introduce a security token that will boost the security of users and assets.

As proof to its dispositions to make transactions safer and smoother, it already has the approval of relevant agencies around the globe. For instance, BaFin, which is Germany’s largest financial coordinator, as approved the activities of this project. In the same regard, it has the nod of the European Union to transact within the region. On that note, it’s clear that Bitbond has working features.

*Architecture*

The blockchain basis of every decentralized project is always a cause for concern because this determines its success or failure. In Bitbond's case, it forged an alliance with one of the largest and most efficient blockchain-based platforms in the world – Stellar. Considering the fact that it aims at enhancing cross-border transactions using crypto coins, it's imperative to use a viable platform that has proved its mettle in the field.

The choice of the Stellar blockchain is because of the efficiency that ensures “zero lag” on transactions. On the same note, the platform has the capacity to facilitate many transactions in real-time and at low costs.

The services provided by Bitbond includes:

*Market Lending

*SME loans

*Amazon loan

*eBay SEO

*Fixed income investment

The fixed income investment allows bitcoin owners to lend bitcoin to businesses that are small across the globe. Bitbond has basically been operating since 2013 and presently spans over 110 countries. This option allows bitbond to connect lenders with worthy borrowers. So if you have some bitcoin to spare, it’s a nice option that you invest here and earn extra.

Taking a cursory look at marketplace lending, undersized business loan, Amazon loan, eCommerce loan and eBay loan indicate it is meant for borrowers. With these service proprietors of business and traders have the ability to apply for a quick loan with a view to get funds via bitcoin.

.png)

Lender of Coin: The main purpose of the project is to issue loans to various companies or businesses via digital money such as Bitcoin or Lumen. This process is done on the platform whereby borrowers who are signed in on the site make a request for loans, they are then issued the loans alongside with the interest rate accrued.

The issuer will inspect relevant documents for verification purposes, a credit assessment will also be carried out which is a run through check on the borrower's bank account transactions and business transactions.

Following the quest to utilize the infrastructure in this type of business, the issuer has to open a crypto account, through which he can invest in crypto loans. So, when the loan request comes in, and very well meets the issuer investment criteria i.e.(amount of loan, country of origin of the borrower, credit rating ) an agreement is brokered online directly between borrower and lender or investor.

Loans will be repaid based in the agreed term, reminders will be sent to borrowers asking him/her to credit wallet. If the borrowers’ status is in default, Bitbond takes over processes.

Network Lending: The issuer can also grant loans to the Bitbond network, having either fixed or varied interest rate. By doing this the economic success of the project is been contributed to by the issuer.

3.0 Comparing Token Bond to Customary Bond

3.1 Intermediaries: No intermediaries to be in charge of affairs, it is a direct P2P transaction, basically, the token will be issued by smart contracts directly investors wallet.

3.2 Programmability: Programmability always has been blockchain’s advantage over regular. In this case, all transactions are automatically executed, transaction including; payments, interest accrued and payback.

3.3 Risks: Take, for instance, if you borrow a sum of $500, the amount is transferred via crypto which is then converted to fiat the same conversation occurs when the money is to be paid back and at the current exchange rate. Hence exposure to volatility But the Bitbond team would operate using stable coins EURT.

*Token sale Information*

Ticker: BB1

Token Type: Security Token

Platform: Stellar

Price: 1 BB1 = 1 EURO

Soft Cap: €5 million EURO

Hard Cap: €10 million EURO

Accepted Currencies: Stellar (XLM), Fiat, Ethereum (ETH), Bitcoin (BTC)

Country of Registration: Germany

Not Participating: Canada and the USA

*TEAM*

*Conclusion*

This is the future of loan financing leveraging on the blockchain. The BB1 token will basically be very successful giving its rich prospects and wealthy Bitcoin investors, whales can seize this opportunity to move funds.

The essence of Bitbond is to enthrone faster transactions and enable crypto loans. With working frameworks and backing from relevant sources, this project is ready to hit the moon.

Website: https://www.bitbond.com/

YouTube: https://www.youtube.com/user/Bitbond

Instagram: http://instagram.com/bitbondofficial/

Twitter: https://twitter.com/Bitbond

Facebook: https://www.facebook.com/Bitbond/

Telegram: https://t.me/BitbondSTOen

Prospectus Link: https://www.bitbondsto.com/files/bitbond-sto-prospectus.pdf

Author (3pas): https://bitcointalk.org/index.php?action=profile;u=2635801

ETH Adress: 0x4bDd6F4dDbC8Eecb266bB107f1Aa10e3E0e9DBa1

Komentar

Posting Komentar