FinWhaleX is a P2P loan platform that provides access to loans anywhere and anytime based on blockchain technology, machine learning, and Big Data.

How does it work?

*You place a loan application*

1. When making your loan application, the Borrower sets parameters according to his choice (amount, interest rate, period, etc.). We recommend evaluating the parameters of other applications that have been placed on FinWhaleX - lenders choose the most profitable application for themselves. You can choose when to secure a loan application with collateral. There are two ways available. On the one hand, you can place a guaranteed loan application that is more attractive to creditors. On the other hand, you can transfer the amount of collateral required after the creditor receives your application. When placing a loan application, you need to pay a transaction fee of 0.5% of the loan amount depending on the loan period.

*Lenders accept your loan application*

2. All creditors guarantee to fulfill their obligations for applications received. After the lender accepts the application, FinWhaleX will generate a special multisig address where your collateral (bitcoin) will be stored until the end of the loan period. Each party only has one private key for multisig addresses. Multisignature (multisig) refers to requiring more than one Private key to authorize Bitcoin transactions. This guarantees that no one can access a guarantee that has only one Private key.

*You return the loan within the term of the loan*

3. After repaying the loan, you automatically return the deposit to yourself. Nobody can use your bitcoin until the loan is repaid - they are frozen in a special wallet. You cannot return a loan, if it is not profitable for you. If the bitcoin rate hasn't gone up or down, then you can refuse to pay back the loan. In this case, the guarantee only falls to the lender, and your loan obligations are paid off.

*Market Potential*

According to a report published by Allied Market Research1

in March 2017, the peer-to-peer (p2p) loan market in 2015 was estimated at $ 26 billion, and in 2022 - $ 460 billion, averaging 51.5% per year. In addition, in 2015, loans for small businesses will be applied in the market, and it is expected that consumer market share will grow rapidly2.

In addition, according to a study by Adroit Market Research on May 8, 2019, the annual capacity of the global P2P loan market in 2017 is estimated at 231 billion US dollars, which could triple its level over the next 8 years (until 2020). It should be noted that the demand for products in this market is very impressive. North America and Asia Pacific.

The p2p interaction format is familiar to younger generation of users. Significant audiences use p2p payments at WeChat instant messenger China, a large audience uses p2p files hosting BitTorrent. The success of fiat P2P loan platforms throughout the world is also impressive5. We consider our product launch on the market on time, it will depend on an established and ready consumer audience.

*Platform Token*

FWX Token is a token utility that is implemented according to the ERC-20 standard in the Ethereum blockchain.

Token holders have access to the platform, increase credit points, have the ability to take loans and lend to other users.

All transactions on the platform will only be done via FWX tokens. For example, issuing loans that are guaranteed by FWX tokens.

FWX tokens will allow holders to use the FinWhaleX platform to take loans and lend to others.

*Security Token*

After IEO, tokens will be available on major crypto exchanges. The platform's main functions will only be available for FWX tokens.

The loan process transaction will be done through the user's wallet

on the FWX platform at FWX, thereby ensuring glass filling for purchases on third-party exchanges.

Further partnerships with exchanges / platforms.

Digital goods will also be produced through FWX tokens.

1. FWX is traded freely.

2. Currency risks arise in a short time - in the transaction processing.

3. Guarantees are valued in dollars, the loan amount is calculated in dollars.

4. Commissions on the platform are formed in FWX tokens which can be saved or changed to Crypt / Fiat.

5. In the Exchange scheme, it can be one exchange for all or different exchanges ... where FWX is traded. To ensure liquidity, Market Maker / Taker is needed.

6. In addition to the platform commission, the lender / borrower will still have FWX Conversion fees - there / back.

7. The payment process is reversed, the borrower buys FWX and pays the loan, the platform gets a commission, the rest reaches the lender.

We implement tokens through verified exchanges.

The reliability of our project — sale of tokens through exchanges that have already earned credibility on the crypto market. They thoroughly check issuers who want to launch IEO and approve only a small part of applications..

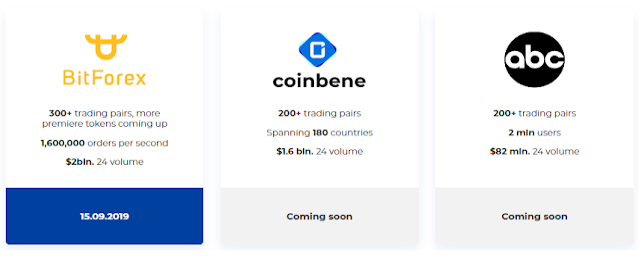

FinWhaleX tokens will be sold at the following sites:

Reliable, Fact-based Business.

Р2Р — this is peer-to-peer lending, in which the loan is provided by private investors at an agreed interest rate. Banks and MFIs are not involved in the chain, which greatly facilitates the achievement of results.

Studies of relevant organizations speak in favor of further scaling this area:

A report published by Allied Market Research in March 2017 indicates that the peer-to-peer lending market will reach 460 billion USD by 2022, increasing by an average of 51.5% per year.

The Adroit Market Research study dated May 8, 2019 showed that the capacity of the global market for P2P lending in 2017 was estimated at 231 billion USD with a potential of threefold increase over the next 8 years (until 2025 ).

This type of lending is gaining momentum, more and more P2P sites are emerging, the volume of transactions is growing. This suggests that investing in such a business is currently one of the most profitable and low-risk ones.

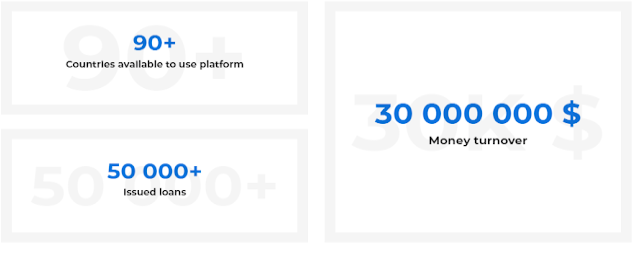

*Planned Indicators By 2021*

The FinWhaleX P2P platform is equally beneficial for all process participants A great option for those who do not want to get involved with banks and MFIs . Loan processing through our platform is:

*The ability to get money with a bad credit history.

*Interest rate is lower than in any financial institution.

*Prompt receipt of money without unnecessary bureaucratic procedures.

Suitable for those who want to increase their income without spending a lot of time and effort on finding options. Providing a loan through our platform is:

*Higher interest rate than bank deposit.

*Less risk of losing money due to collateral.

*Opportunity to independently choose who to lend.

The best option for those who are aware of the potential of the crypto market and lending. Acquiring our platform tokens is:

*Getting a stable profit, regardless of the economic and political situation.

*Possibility to resell tokens in the future at a higher price.

*Participation in market scaling with huge potential, promising high dividends.

FinWhaleX: change the conditions of the financial market:

*Liquidity provider

*Simplified the cryptocurrency trading process and made it more profitable for each side of the process.

*Virtual card

*Digital assets are connected to a virtual card in the application, they can be calculated in 40+ million terminals around the world.

*Mobile app

*Work with the platform is carried out via a smartphone without the need to issue paper requests.

*We work around the world

*The platform is not limited to one region, it is available for use in different countries.

*Justification

*Registered in Singapore, obey laws and monitor compliance with international standards to prevent illegal activities.

*Ease of use

*Currency conversion is performed within the platform, enabling borrowers and lenders to use their preferred currency.

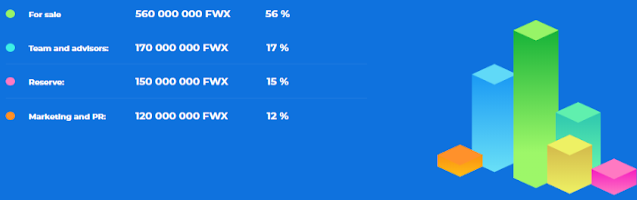

*Project Token Distribution*

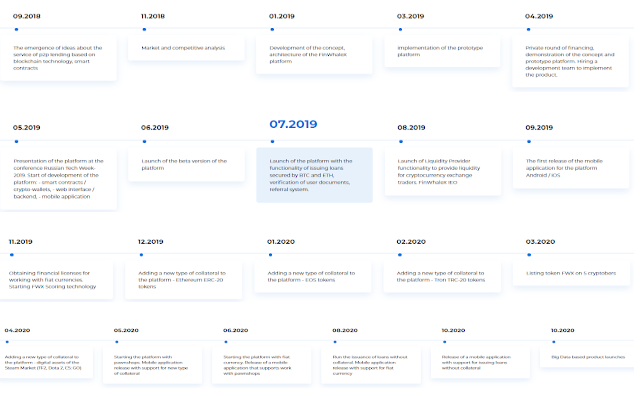

*ROADMAP*

The list of reasonable expenses for a successful project has already been compiled.

Before the start of IEO, we thought about how we would direct the funds raised to bring the platform to a new stage of development, give more opportunities to borrowers and lenders, ensure a steady flow of profits to investors.

Peer-to-peer (P2P) lending is one of the fastest-growing sectors of the financial industry. In fact, a report published by Allied Market Research in 2017 estimated that the global peer-to-peer lending market would increase by almost 52% per year, reaching the US $460 billion in value by 2022.

In case one strong projection wasn’t enough, another independent report by Adroit Market Research in 2019 found that the global P2P lending market was worth the US $231 billion already in 2017, while it can potentially increase to nearly $700 billion by 2025 — right in line with the Allied Market Research report.

With the continued development of blockchain infrastructure and smart contracts, cryptocurrencies are sure to play a significant role in the P2P lending market going forward. There are already a few decentralized lending solutions out there, with plenty of room for others to join the competition in the years ahead.

But it’s not just going to be the big names like Bitcoin and Ethereum that are at the center of this sector’s expansion. A new project in the space, FinWhaleX, is developing a solution that enables people to use digital assets on Steam as collateral, too.

Steam is the largest platform in the world for digital distribution of PC games and video game assets. More than 10 million people use Steam every single day, and the platform had revenue of $4.3 billion in 2017. Needless to say, there are many people who have a significant amount of value stored in digital assets on Steam. For example, there are virtual environments, outfits, weapons, and other tradeable items in popular games such as CS:GO, DOTA 2, and Team Fortress 2 (TF2).

FinWhaleX is working on the finishing touches of integrating Steam into their P2P lending platform so that Steam users can put their virtual assets up as collateral to receive loans. Once completed, they’ll launch a beta testing phase to begin preparing the service for mainstream use.

For an idea of how it will work, let’s imagine that a Steam user, John, is low on cash and needs to get a loan. Centralized loan services tend to be expensive and full of hassles, so John looks for something decentralized that won’t have as high of interest and can help him get the funds he needs immediately.

Thanks to his PC gaming hobby, John has about $700 worth of virtual assets on Steam. On FinWhaleX, John can simply use his Steam inventory as a collateral deposit to get a $350 loan from a creditor. After he pays back the loan plus the agreed-upon amount of interest, John’s inventory is unlocked and returned. In the event John can’t pay back the loan on time, the platform automatically sells the assets on Steam and transfers the money to the creditor.

In this way, creditors face minimal risk in lending out their money, while borrowers can get fast and easy access to capital without needing to surrender to the hassles and high costs of traditional lending services. It’s an ideal solution for Steam’s 10+ million users and one which can certainly help with the expansion of the P2P lending market and the decentralized finance movement as a whole.

Website: https://finwhalex.com/

Telegram: https://t.me/finwhalex

Facebook: https://www.facebook.com/FinWhaleX/

Twitter: https://twitter.com/FinWhaleX/

Author (3pas): https://bitcointalk.org/index.php?action=profile;u=2635801

ETH Address: 0x4bDd6F4dDbC8Eecb266bB107f1Aa10e3E0e9DBa1

Komentar

Posting Komentar